Charitable Remainder Unitrust

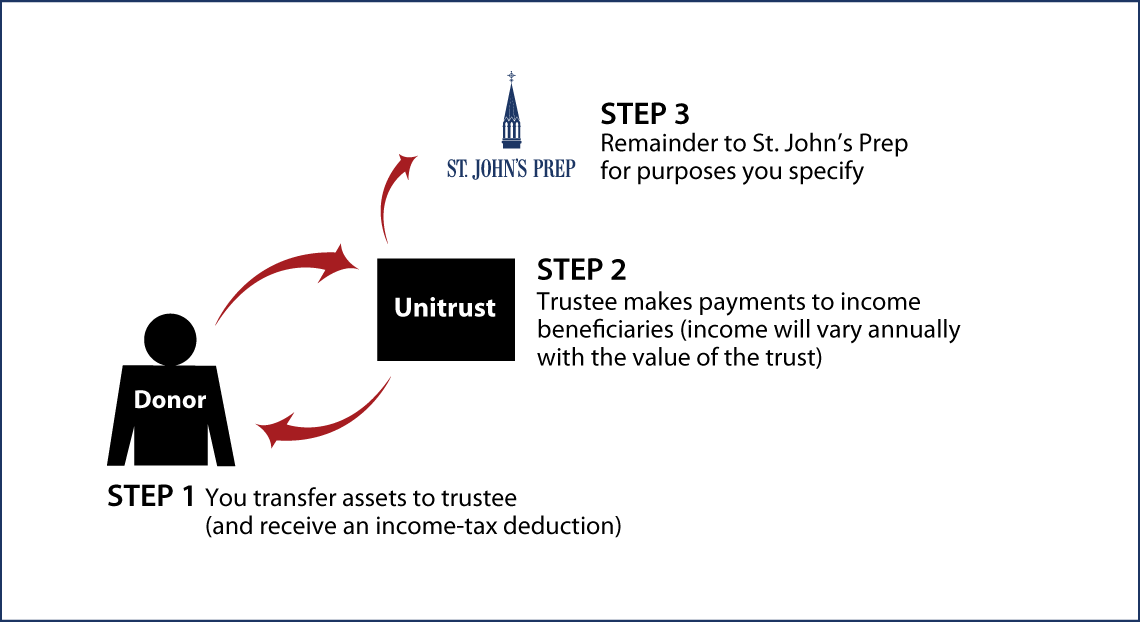

How It Works

- Create trust agreement stating terms of the trust; transfer cash or other property to trustee

- Trustee invests and manages trust assets and makes payments to income beneficiaries you designate

- Remainder to St. John's Prep for purposes you specify

Benefits

- Payments to one or more beneficiaries, varying annually with the value of the trust

- Federal income-tax deduction for the charitable remainder value of your interest

- No capital-gain tax when trust is established; property is sold by the trust

- Trust remainder will provide generous support for St. John's Prep

Request an eBrochure

Request Calculation

Contact Us

Paul Chiozzi

Managing Director of Leadership Giving

978-624-1388

pchiozzi@stjohnsprep.org

St. John’s Preparatory School

72 Spring Street

Danvers, MA 01923

Federal Tax ID Number: 04-2104875

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer